Long-term assets (also known as fixed or capital assets) are those that a company expects to use; replace, and/or convert to cash after the normal operating cycle of at least 12 months. This distinguishes them from current assets, which companies typically expend within 12 months. Also, long-term assets, like current assets, appear on the balance sheet. They represent the entirety of a company’s assets.

What are Long Term Assets?

Long-term assets are assets that will benefit the company for more than a year, whether they are tangible or intangible. Long-term assets, also known as non-current assets, can include fixed assets such as a company’s property; plant, and equipment, but they can also include long-term investments, patents, copyright, franchises, goodwill, trademarks, trade names, and software.

Long Term Assets Examples

Long-term assets are those that have been on a company’s balance sheet for a long time. Long-term assets can include both tangible (physical) and intangible (intangible) assets, such as a company’s trademark or patent.

Some examples of long-term assets include:

- Property, plants, and equipment, which also include land, machinery, buildings, fixtures, and vehicles.

Related Articles: Best Farmers Insurance Review 2022

- Long-term investments in stocks, bonds, or real estate, as well as investments in other companies.

- Trademarks, customer lists, and patents

- Goodwill is acquire as part of a merger or acquisition, which is also consider as an intangible long-term asset.

Changes in long-term assets on a company’s balance sheet can indicate either capital investment or liquidation. If a company is investing in long-term growth, it will use revenues to make additional asset purchases; that will drive earnings in the long run. However, investors should be aware that some companies will sell long-term assets to raise cash to meet short-term operational costs; or pay the debt, which can be a warning sign that a company is in financial trouble.

Long-Term vs. Short-Term Assets

Current and non-current assets are the two main types of assets on a balance sheet. Companies rely on their current assets to fund ongoing operations and pay current expenses, such as accounts payable. Furthermore, current assets include cash, inventories, and accounts receivable. Non-current assets are long-term assets with a useful life of more than a year and typically last for several years.

Related Articles: PROPERTY DAMAGE LAWYER: When You Need a Property Damage Lawyer

Depreciation of Long-Term Assets

Depreciation is an accounting practice that allows businesses to expense a portion of their long-term; operating assets used in the current fiscal year. Analysts frequently consider earnings before depreciation of assets (e.g., EBITDA) as a key factor in understanding a company’s financial situation; because depreciation can obscure the true value of long-term assets and their impact on a company’s profitability.

Limitations of Long-Term Assets

Long-term assets can be costly and require large amounts of capital; which can also deplete a company’s cash reserves or increase its debt. One limitation of analyzing a company’s long-term assets is that investors; may not see the benefits for a long time, possibly years. Also, investors must rely on the management team’s ability to forecast the company’s future and allocate capital wisely.

Drug companies spend billions of dollars on R&D to develop new drugs, but only a few make it to the market and are profitable.

Related Articles: RESIDENTIAL STRUCTURAL ENGINEER: How & When To Hire a Structural Engineer

Investors should examine a company’s long-term assets holistically, just as they would any other financial metric. When conducting a financial analysis of a company, it is best to use multiple financial ratios and metrics.

Terminology for Long-Term Assets

It is necessary to become familiar with some terminology to better understand how long-term assets affect a company’s financial health.

Property, Plant, and Machinery

Property, plant, and equipment (PP&E) refer to a company’s long-term assets that are critical to the manufacturing process. Also, property refers to any property or proprietary assets used in the company’s production.

Book Value

When a company acquires PP&E or other long-term assets, it initially records the value of the assets; at the time of purchase, which becomes their book value. The number is usually recorded as the purchase price that was paid; by the company in order to acquire the asset.

Carrying Value

The carrying value of a long-term asset is the asset’s value on the company’s books. The carrying value is the asset’s original cost less any accumulated depreciation. It can be thought of as the asset’s historical accounting value.

Related Articles: TRUST ATTORNEY: Do I Need One?

Long Term Assets on The Balance Sheet

Long-term assets are typically presents on the balance sheet in the following categories:

- Investing

- Net property, plant, and equipment

- Intangible property

- Additional assets

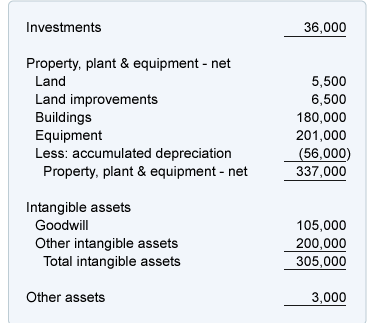

The long-term (or non-current) asset section of our sample balance sheets is as follows:

Investments

The initial long-term asset investments will include amounts such as:

- Long-term investments in stocks, real estate, or other businesses.

- Property that is currently on sale

- The cash surrender value of the company’s life insurance policies

- Bond sinking funds and other assets with a long-term focus

Related Articles: How Much Does A Nose Job Cost With Insurance: Best Price Review

Property, plant, and equipment – net

Property, plant, and equipment (net) is a balance sheet category that includes the cost of non-current; tangible assets used in a business, less accumulated depreciation.

These figures are most likely not the same as those reported on the company’s income tax return. The lists below are commonly found under property, plant, and equipment in the financial statement notes:

- Land

- Land improvements

- Buildings and improvements

- Machinery and equipment

- Furniture and fixtures.

- Construction in progress.

- Less: accumulated depreciation

Land

Land refers to the use of land in a business, such as the land on which manufacturing facilities, warehouses, and office buildings have been (or will be) built. Because the cost of land does not depreciate, its records and reports are separate from the cost of buildings.

Land improvements

Parking lots, lighting, and driveways are examples of land improvements. These will depreciate throughout their useful lives.

Related Articles: PROPERTY DAMAGE LAWYER: When You Need a Property Damage Lawyer

Buildings and improvements

The cost of the buildings and improvements is reported in the line buildings and improvements; but not the cost of the land on which they were built. For financial statement purposes, the cost of buildings and improvements will depreciate over their useful lives.

Equipment and Machinery

On the balance sheet, the cost of a company’s production assets reports as equipment, machinery, and equipment. Because machinery and equipment do not last forever, their costs depreciate on financial statements throughout their useful lives.

Furniture and fixtures.

The cost of furniture and fixtures is reported. Their purchase price will be depreciated in the financial statements throughout their useful lives.

Construction in progress

A company’s long-term assets construction in progress accumulates the costs of constructing new buildings, additions, equipment, and so on. Each project’s costs accumulate separately and will send to the appropriate property; plant, or equipment account when the asset is placed into service. The depreciation of the constructed asset will begin at that point.

Intangible assets

Intangible assets are assets that lack physical substance. Purchased intangible assets (as opposed to those acquired as a result of effective advertising; training, and so on) are reported on two long-term asset lines:

- Goodwill

- Additional intangible assets

Goodwill

Goodwill is an intangible asset that is recorded when a company purchases another company for more than; the fair value of its identifiable assets. Assume a corporation pays $5 million to acquire a business with $4 million in fair value intangible; identifiable intangible assets. Intangible asset goodwill accounts for the $1 million difference.

Additional intangible assets

The line other intangible assets refers to intangible assets purchased from a third party other than goodwill. Some examples are as follows:

- Copyrights

- Mailing lists

- E-mail lists

- Trademarks

- Patents (including the cost of defending existing patents)

Other assets

Other assets are a non-current asset balance sheet item that reports the company’s deferred costs, which will be charged to expense more than a year after the balance sheet date.

Frequently Asked Questions

What are long term and short term assets?

Long-term assets are those that are used in the business for a long period, i.e., more than a year, to generate revenue, whereas short-term assets are those that are used for less than a year and generate revenue/income within a year period.

Is it good to have long term assets?

Long-term assets account for a sizable portion of the company’s total fixed costs, which will be advantageous in the future. Data on an organization’s long-term assets is important because it aids in the preparation of accurate financial reports, business valuations, and financial analysis.

What are 3 types of assets?

Current, non-current, physical, intangible, operating, and non-operating assets are examples of common asset types. Correctly identifying and classifying asset types is critical to a company’s survival, particularly its solvency and associated risks.

What are examples of short term assets?

Short-Term Asset Examples

- Cash.

- Securities that are tradable.

- Accounts receivable in trade.

- Accounts receivable for employees

- Expenses prepaid (such as prepaid rent or prepaid insurance)

- Inventories of all kinds (raw materials, work-in-process, and finished goods)

What are short term assets?

Important Takeaways Short-term assets are assets held for a year or less, with accountants using the term “current” to refer to an asset that is expected to be converted into cash within the next year. Current assets include both accounts receivable and inventory balances.