A credit shelter trust is a tool used by wealthy couples to reduce or avoid estate tax liabilities when one spouse dies. Furthermore, while the surviving spouse is still alive, this tool allows them to retain certain rights to the trust assets. When the surviving spouse dies, the trust’s assets pass to the remaining beneficiaries tax-free. Learn more about credit shelter trusts and how they can help you.

What is a Credit Shelter Trust

A credit shelter trust (CST) is a trust established after the death of a married couple’s first spouse. Assets placed in the trust are typically held separately from the surviving spouse’s estate; so that they can be transferred to the remaining beneficiaries upon the death of the surviving spouse.

The assets held in the CST can only benefit the surviving spouse while they are alive. Furthermore, the credit shelter transfer not only saves the deceased spouse’s death tax credit but also shields the assets from; the creditors and future spouses of the surviving spouse.

Related Articles: Best Oasis Insurance: Full Product Review

The credit shelter trust can also be set up to ensure that the assets pass to the deceased spouse’s children or family upon the death of the surviving spouse. Keeping them out of the surviving spouse’s next spouse’s reach.

Benefits of a Credit Shelter Trust (CST)

Because assets transferred to a surviving spouse are exempt from federal estate taxes; a credit shelter trust serves as a tax management tool. There is no cap on this amount. Normally, after the death of the second spouse, taxes are levied on any assets from that spouse’s estate that are passed on to beneficiaries. Assets placed in a credit shelter trust, on the other hand, are not considered part of the surviving spouse’s estate. As a result, after the second spouse dies, they are eligible to pass on to beneficiaries without being taxed. Any appreciation in the value of the trust assets can also be bequeathed tax-free.

Consider a married couple with a $15 million estate as an example of how this works. Without estate planning, the estate of the second-to-die spouse would be $3.3 million larger than the federal estate tax exemption of $11.7 million in 2021. The estate would pay $1.32 million in taxes on the $3.3 million excess if the top tax rate was 40%. In addition, a base tax of $70,800 is levied on the first $11.7 million. The estate tax would total $1,390,800. All of this tax would be avoided with a credit shelter trust.

Credit Shelter Trust Limits

Credit shelter trusts are most useful when each spouse’s assets exceed the estate tax exemption amount. They are not commonly used when estates are less than the exemption amount.

Related Articles: What No One Tells You About McGriff Insurance in 2022

It is an irrevocable trust, which means that its terms cannot be changed. Because the surviving spouse has limited control over trust assets, the needs of the surviving spouse must be carefully considered when establishing the trust.

Credit shelter trusts are required to file federal income tax returns as well. This can be time-consuming and expensive, and it must be accounted for in the trust documents.

Example of a Credit Shelter Trust

Assume a husband and wife who have been married for several years amass an estate worth $6 million each, and the husband establishes a credit shelter trust to be funded with his share of their combined estate upon his death. Because his estate is less than the federal exemption, the husband’s $6 million estates and any income generated by it pass estate tax-free to his wife after his death.

The transfer, however, raises the wife’s net income to $12 million, pushing her past the estate-tax exemption. Because these assets are held in trust and are not under the wife’s control, her taxable estate is still valued at $6 million and falls within the estate tax exemption. As a result, when she dies, she can leave her assets to her children tax-free.

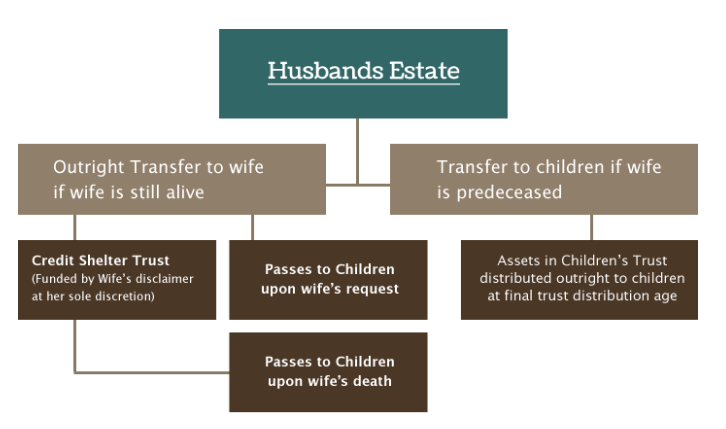

Credit Shelter Trust Diagram

How It Is Put Into Practice

Your attorney can draft your will or living trust to include the necessary provisions and design your trust in the most appropriate manner for your family situation and personal goals.

If you live in a state with its own estate tax, you may need to plan ahead of time. The available state exclusion is lower in a number of states than the federal exclusion. Your attorney can assist you in developing a strategy that accounts for the differences between the federal and state exclusion amounts.

Related Articles: Best HIX Insurance Review: Products and Features

Once you’ve made the necessary provisions in your will or trust, it’s critical to make sure that enough assets pass under your will or trust. Talk to your attorney about how to structure asset ownership, title accounts, and beneficiary designations when writing your will or trust. Your financial advisor can assist you in putting your attorney’s recommendations into action.

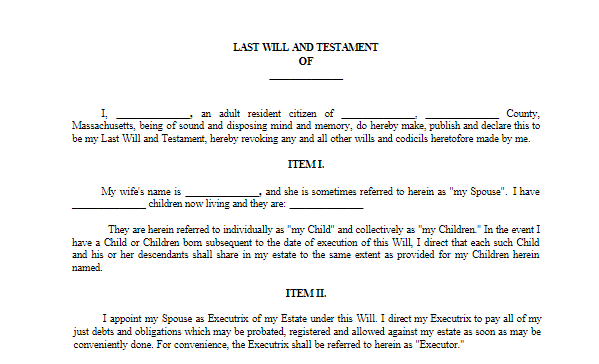

Credit Shelter Trust Form

You can download the sample of the form here

Credit Shelter Trust Requirements

The Credit Shelter Trust was established to allow wealthy couples to reduce or completely avoid estate taxes when passing assets on to their heirs or beneficiaries, who are typically their children.

Furthermore, credit shelter trusts are established upon the death of a married person and are funded with that person’s entire estate or a portion of it, as specified in the trust agreement. These assets are then transferred to the surviving spouse.

Because the trust is managed by a chosen trustee, the surviving spouse never truly has complete control over the trust’s assets. As a result, the transfer has no effect on the surviving spouse’s taxable estate.

Furthermore, a last will and testament can direct that, upon the death of the first spouse, a credit shelter trust be established and funded with a portion or all of the deceased spouse’s available assets.

Related Articles: Roadway Insurance: Full Product Review

The credit shelter trust will still benefit the surviving spouse in that it grants the surviving spouse the right to a portion of the trust’s income. In addition, the ability to withdraw trust principal for the benefit of the spouse’s education, health, maintenance, or support.

Furthermore, the trust assets are valued outside of the surviving spouse’s estate and are tax-free passed on to the remaining beneficiaries when the surviving spouse dies.

Each spouse is expected to have sufficient assets in their own name for this to work optimally. As a result, the total value of each spouse’s assets equals or exceeds the applicable exclusion amount.

A credit shelter trust can be structured in a variety of ways to achieve a specific goal. As a result, it is critical to consult with an estate planning attorney to ensure that it is properly drafted.

Pros and Cons of Credit Shelter Trust

It has a number of advantages, but it also has a disadvantage. The following are the benefits and drawbacks of the credit shelter trust tool.

Pros of Credit Shelter Transfer

The benefits of credit shelter transfer are listed below.

#1. It provides asset protection.

When assets are held in trust by the surviving spouse, they are protected. There are numerous factors that influence the trust’s provision of distribution.

#2. It promotes the use of immunity.

If the proper paperwork is not filed when the first spouse dies; the second spouse may lose his or her immunity. The first spouse to pass on can help ensure that his or her immunity is used by forcing; the financing of the credit shelter trust.

#3. It provides control.

Using this trust, the first to die can influence how the assets are eventually distributed when the surviving spouse dies. This is especially important if there was a previous marriage that resulted in children or if the surviving spouse remarries.

Related articles: BUILDING CONTRACTOR: Job Description, Roles, and Salaries (Updated!)

#4. Keeping the original intention of the trust’s creator safe.

In an integrated family, each spouse may intend to leave their share of the estate to their chosen beneficiaries or children from a previous marriage. When properly set up, a credit shelter trust can effectively carry out this intent.

#5: The trust’s sharing provisions must be flexible.

A limited power of appointment for the surviving spouse can be included in the trust. As a result, the surviving spouse may divide the assets among a group of beneficiaries.

#6. Property tax advantages

A distribution from the credit shelter trust to a child is considered a transfer from the deceased spouse; rather than the surviving spouse. The distribution may qualify for the demised spouse’s $1 million non-residence parent-child property tax reassessment exclusion. Spouses who own valuable rental or vacation properties may benefit from an additional $1 million in reassessment exclusion.

Cons of Credit Shelter Transfer

The disadvantages of credit shelter transfer are listed below.

- Because the trust has a separate tax ID number, it must file a separate tax return.

- The surviving spouse must be willing to accept certain rights and limited control over the trust assets. If the trustee is not the surviving spouse, he or she may receive trust assets for other reasons at the discretion of the trustee.

- In order for the trust to reap the benefits of a credit shelter trust, income tax returns must be filed. If the assets used to fund the trust are complicated, this filing can be time-consuming and costly.

Marital Trust vs. Credit Shelter Trust

A marital trust is a trust relationship formed by the trustor and the trustee for the benefit of the surviving spouse; the heirs of the married couple. A marital trust, also known as an “A” trust, takes effect when the first spouse dies.

Also, a marital trust allows the couple’s beneficiaries to avoid probate and pay less in estate taxes by utilizing the unlimited marital deduction. A provision that allows spouses to transfer assets to each other without incurring tax consequences.

Related Articles: Disclaimer Trust: What are the Pros and Cons?

The remaining trust assets, however, will be subject to estate taxes when the surviving spouse dies. A marital trust is sometimes used in conjunction with a credit shelter trust is known as a “B” trust to avoid this situation.

Conclusion

A credit shelter trust is an irrevocable trust that operates after the death of the trust’s creator or settler. The assets held in the trust, as well as the income generated by them, are distributed to the creator’s spouse. I hope this article has helped you understand what a credit trust shelter is. If you have any questions for me, please leave them in the comments section.

Frequently Asked Questions

What is the purpose of a credit shelter trust?

What Exactly Is a Credit Shelter Trust? A Credit Shelter Trust (CST) is intended to allow wealthy couples to reduce or eliminate estate taxes when passing assets on to heirs, typically their children.

What happens to a credit shelter trust when the surviving spouse dies?

What Happens If the Surviving Spouse Passes Away? When the surviving spouse dies, the trust distributes the remaining assets in accordance with the terms of the trust. The assets in the credit shelter trust, including any appreciation in value during the surviving spouse’s lifetime, pass to the beneficiaries free of the estate tax.

Is a credit shelter trust revocable or irrevocable?

You can change the terms of the trust at any time during your lifetime because it is revocable. When you die, it becomes an irrevocable trust, and assets – usually the remainder of your estate tax exemption – are transferred to the trust. The surviving spouse is now eligible to receive income from the trust’s assets.

Is a family trust a credit shelter trust?

A credit shelter trust is an irrevocable trust that is also known as a bypass trust, B trust, exemption trust, or family trust. It is made up of a contract between a trustor and a trustee, just like any other trust. The trustor is the individual who establishes the trust and provides the assets.