An annuity is a contract that guarantees a series of structured payments over a set period. It begins on a specific date and ends at a specific time. In this article, we will look at the two types of annuities: the ordinary annuity vs. the annuity due, as well as how to use a formula to calculate the present value of an ordinary annuity.

What Is an Ordinary Annuity?

An ordinary annuity is a fixed-term series of equal payments made at the end of consecutive periods. While payments in an ordinary annuity can be made as frequently as once per week, they are usually made monthly, quarterly, semi-annually, or annually. An annuity due is the inverse of an ordinary annuity, in which payments are made at the start of each period. Although they are related, these two series of payments are not the same as the financial product known as an annuity.

How an Ordinary Annuity Works

Ordinary annuities include bond interest payments, which are typically made semiannually, and quarterly dividends from stocks that have maintained consistent payout levels for years. The present value of an ordinary annuity is heavily influenced by the current interest rate.

Rising interest rates reduce the present value of an ordinary annuity due to the time value of money, while declining interest rates increase its present value. This is because the annuity’s value is determined by the return your money could earn elsewhere. If you can find a higher interest rate elsewhere, the value of the annuity in question decreases.

Present Value of an Ordinary Annuity Example

Ordinary annuities are a fixed amount of income paid out annually or regularly. An annuity is a contract with an insurance company in which you make a payment (one-time large payment) or series of payments in exchange for a regular fixed income that begins either immediately or at some predetermined time in the future. The ordinary annuity formula is used to calculate an amount’s present and future value. Let’s look at some solved examples to better understand the ordinary annuity formula.

What is the Ordinary Annuity Formula?

It is critical to calculate the annuity’s future value to account for inflation over time. The ordinary annuity formula is explained below, along with examples and solutions. Three variables are considered in the present value formula for an ordinary annuity. These are their names:

- PMT = the periodic cash payment.

- r = the interest rate per period

- n = the total number of periods

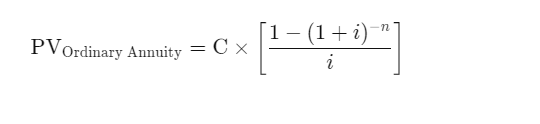

The present value of an ordinary annuity given these variables is:

Present Value = PMT x ((1 – (1 + r) ^ -n ) / r)

For example, if an ordinary annuity pays $50,000 per year for five years at a 7% interest rate, the present value is:

Present Value = $50,000 x ((1 – (1 + 0.07) ^ -5) / 0.07) = $205,010

Example of Present Value of an Annuity Due

Remember that with ordinary annuities, the payment is made at the end of the period. In contrast, with an annuity due, the investor receives the payment at the start of the period. A common example is rent, which is typically paid in advance to the landlord for the month ahead. The annuity’s value is affected by the difference in payment timing. The following is the formula for calculating an annuity due:

Present Value of Annuity Due = PMT + PMT x ((1 – (1 + r) ^ -(n-1) / r)

If the annuity in the preceding example was a due annuity, its present value would be calculated as follows:

Present Value of Annuity Due = $50,000 + $50,000 x ((1 – (1 + 0.07) ^ -(5-1) / 0.07) = $219,360.

An annuity due is always worth more than an ordinary annuity because the money is received sooner.

Calculate Ordinary Annuity

The following formulas can be used to calculate the present or future value of an ordinary annuity vs. an annuity due.

How to Determine the Future Value of an Ordinary Annuity

Given a specified interest rate, future value (FV) is a measure of how much a series of regular payments will be worth at some point in the future. So, if you plan to invest a certain amount each month or year, it will tell you how much you will have accumulated at a later date. If you make regular loan payments, the future value can help you calculate the total cost of the loan.

Consider a five-payment series of $1,000 made at regular intervals.

Because of the time value of money, the first $1,000 payment is worth more than the second, and so on. Assume you invest $1,000 every year for the next five years, earning 5% interest. The amount shown below is what you would have at the end of the five-year period.

Rather than calculating each payment separately and then adding them all up, you can use the following formula to determine how much money you’ll have in the end:

Using the preceding example, here’s how it would work:

Note that the one-cent difference in these results, $5,525.64 vs. $5,525.63, is due to rounding in the first calculation.

How to Determine the Present Value of an Ordinary Annuity

A present value (PV) calculation, in contrast to a future value calculation, tells you how much money is needed now to produce a series of payments in the future, assuming the same interest rate.

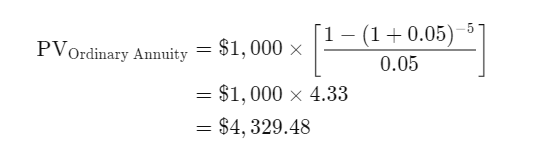

Here is an example of a present value calculation using the same example of five $1,000 payments made over a five-year period. It demonstrates that $4,329.58 invested at 5% interest would be sufficient to generate those five $1,000 payments.

This is the relevant formula:

When we plug the same numbers as above into the equation, we get the following result:

The above-mentioned formulas make it possible—and relatively simple, if you don’t mind the math—to calculate the present or future value of an ordinary annuity or an annuity due. With the correct inputs, financial calculators (which can be found online) can also calculate these for you.

Ordinary Annuity vs. Annuity Due

A contract between a policyholder and an insurance company is referred to as an annuity. With this contract, policyholders make a one-time payment to the insurance company in exchange for a series of payments made instantly or at a later date. There are various types of annuities that people should be aware of and understand.

An ordinary annuity pays you at the end of your covered term, whereas an annuity due pays you at the start of your covered term. If you have an annuity or are thinking about getting one, here’s what you need to know about the difference between an ordinary annuity vs. an annuity due.

Key Differences: Ordinary Annuity vs. Annuity Due

There are several important distinctions between an ordinary annuity and an annuity due. The most noticeable distinctions are in how they pay out and how they are valued. The following are the distinctions between ordinary annuity vs. annuity due:

Payouts

The primary distinction between ordinary annuities and annuities due is how they are paid out. All annuities make a payment once per period, just like bills are due once a month. Payments are made at the end or beginning of the period. Payments are made at the end of each payment period with ordinary annuities. When an annuity is due, the payment is made at the beginning. Loan payments are typically made at the end of a cycle and are considered annuities. Insurance premiums, on the other hand, are typically due at the start of a billing cycle, as are annuities.

Present Value

The cash value of all future annuity payments is the present value of an annuity, which is based on the time value of money. Because of inflation, a dollar today is worth more than a dollar at the end of the year, according to the time value of money concept. When comparing annuities, keep in mind that the length of a billing cycle can have a significant impact on the annuity’s present value. As a consumer, you can request an annuity schedule from your lender or investment advisor.

What it Modifies

Annuities will be calculated by lenders and investment firms. You have access to annuity calculations as a consumer because they are used to calculate how much you are charged. Due to interest accrual, if you make your payment at the end of a billing cycle, your payment will most likely be larger than if you make your payment immediately.

Which Annuity Is Best?

In general, ordinary annuities are most advantageous to a consumer when payments are made. In contrast, when a consumer is collecting payments, an annuity due is most advantageous. Due to inflation and the time value of money, payments on an annuity due have a higher present value than payments on an ordinary annuity.

When a payment is made at the end of a period, this is referred to as an ordinary annuity. When a payment is due at the start of a period, it is referred to as an annuity due. While the difference may appear insignificant, it can have a significant impact on your total savings or debt payments. Keep in mind that an annuity, which is an insurance product rather than an investment, may not be suitable for everyone.

Conclusion

In a nutshell, because payments are made at the end of a pay period, an ordinary annuity almost always benefits the party making them. This is distinct from an annuity payment, which almost always benefits the party receiving the payments.

Frequently Asked Questions

Why is ordinary annuity important?

In a nutshell, because payments are made at the end of a pay period, an ordinary annuity almost always benefits the party making them. This is distinct from an annuity payment, which almost always benefits the party receiving the payments.

Is ordinary annuity better?

An ordinary annuity is appropriate when a person is making payments, whereas an annuity due is appropriate when a person is receiving payments. The payment made on an annuity due has a higher present value than the regular annuity.

What are the differences between an ordinary annuity an annuity due and perpetuity?

Ordinary Annuity: A cash payment or deposit is made once a year. Annuity Due: The cash inflow or outflow occurs at the start. Perpetuity: an annuity that lasts forever. Other annuity types include fixed annuities and variable annuities.

What is general annuity?

A general annuity is an annuity in which the payments do not correspond to the interest periods. You will see that dealing with general annuities is very simple once an equivalent interest rate is determined, with that equivalent rate compounded as frequently as the payments are made.

Related Articles: